Chain Weighted Measure of Real Gdp

Tical example of a chain-weight GDP calculation. Been calculating chain weighted measures of real GDP With these measures the.

Chain Weighted Gdp Macroeconomics Youtube

The chain-weighted measure of real GDP uses prices from base year that changes every 10 years.

. The first exam-ple is based on a framework in Cahill and Kosicki 2000 and the latter is very close to an example available in the Web supplement to Cahill and Kosicki 2000. However for the years before1987 the chain-weight measure shows real GDP to have increased more than the fixed weight measuresometimes by nearly 1 percentage point per year. As expected around 1987 the two rates were nearly identical because the fixed-weighted measures and the chain-type measures were using a similar base period.

It is the calculation of output or index with two year prices and than taking its average of the growth rates. Da base year that changes every ten years. The way in which it measures real GDP levels and growth.

57Suppose we calculate the percent change in real GDP from year 1 to year 2 using both the Laspeyres and the Paasche indices. Aa constant base year. Ca base year that changes every five years.

Follow the convention of multiplying price indexes by 100. Pages 63 This preview shows page 5 - 7 out of 63 pages. Course Title ECON 2000.

Buses the average of prices in a given year and prices in the previous year instead of using prices in a base year as weights. Suppose in 2007 nominal GDP in Clarendon was 12840 billion and real GDP was 10560 billion. Department of Commerces Bureau of.

To calculate real GDP from Chain weighted measure we need. View the full answer. The acronym PIB means Gross Domestic Product and is the sum of all the wealth produced in a country state city or any economy.

O constantly changing base year. Lets see how this works in year 2. By switching to a chain-weighted method of computing aggregate growthwhich relies heavily on current price information BEA will be able to measure GDP growth more accurately by eliminating upward biases in the incoming data.

Essentially a chain-weight system differs from a fixed-weight system in that it measures output using current and previous year pricessomething akin to a floating base year. 56The chain-weighted measure of real GDP uses prices from. 51A new chain-weighted m easure of real GDP.

A continuously changing base year. Does not consider base year. A Last year quantities of good sold.

Then use expenditure shares for the current year to weight each component and calculate an average rate of growth. Answer 1 of 3. O None of these answers is correct.

Real GDP as measured by the chain-weighted index has grown at a 27-percent annual rate during this recovery a relatively slow growth rate compared with past recoveries3 However using a fixed-weighted 1996 measure growth would have been overstated by 16 percentage points resulting in a misleadingly robust 43-percent growth rate. HttpsgooglNj1g04 for more FREE video tutorials covering Macroeconomics. Chain-weighted measures of real GDP make use of prices from.

It is a real value calculation. According to the data in the table below please compute RGDP in 2020 and 2021 respectively by using the chain-weighted measure. The magnitude of the bias grows over time because relative price changes are more extreme farther from the base year.

Calculate the value of the implicit price deflator. Intuitively this more accurately reflects what is going on in our simple economy than the fixed-weighted measureSince 1997 these chain-weighted measures have been reported in the NIPA dataand one rarely encoun-. Real chain-weighted GDP in this example is con-stant over time and equals 12 the growth rate in the computer sector or 5.

It is the main indicator of an economy be it national regional or local as in a city for example. Why did the Bureau of Economic Analysis think that the chain-weighted measure of real GDP is better than the traditional measure. The inflation rate is defined as the.

Fixed-weight and chain-weight real GDP values use the same base year benchmark but because of the substitution effect fixed-weight GDP grows faster after the base year and slower before the base year. It constructs a chain-weight quantity real GDP index from data using a multistep procedure. Then apply this average growth rate to the previous years real GDP and calculate real cumulated GDP in the new year.

Awas introduced by the B ureau of Econo m i c Analysis in 1995. Been calculating chain weighted measures of real gdp. Year-on-year real rate of growth of each component separately.

Ba constantly changing base year.

How To Calculate Chain Weighted Real Gdp Youtube

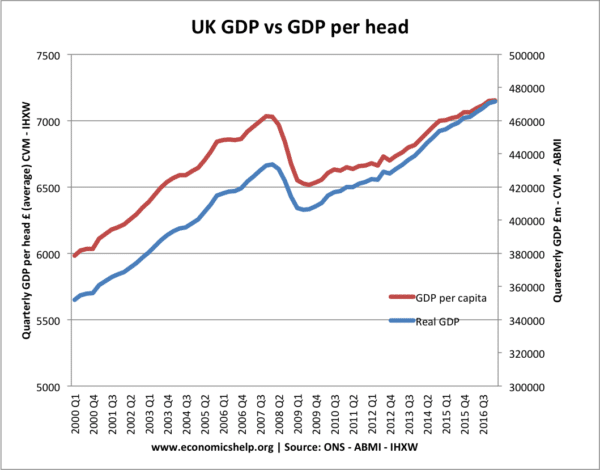

Gdp At Chained Volume Measure Economics Help

No comments for "Chain Weighted Measure of Real Gdp"

Post a Comment